1. Union Budget 2019: All you want to know about the Budget; Process of Budget approval

Finance Minister Piyush Goyal will be presenting the Union Budget 2019-20 on February 1, 2019. It will be the last Budget of the Modi Government before the 2019 Lok Sabha elections.

This year, the government will present the Interim Budget, also known as ‘Vote on Account’ as it is close to the end of its term. An interim budget is usually passed by the Lok Sabha without discussion. Budget is an estimate of revenues and expenditure of the Government during a financial year (April-March).

2. Union Budget 2019-20: Full Budget vs Interim Budget

The Union Government led by Prime Minister Narendra Modi would be presenting Interim Budget 2019-20 on February 1, 2019, the last budget of the NDA government before the 2019 Lok Sabha Elections.

The Interim Budget is also known as a vote-on-account or approval, which the government seeks from the parliament for essential spending for a limited period, the first four months of the fiscal year in which the elections are scheduled. The full-fledged budget is then presented by the new government.

3. India improves its ranking on Corruption Perceptions Index 2018; moves to 78th position

India improved its ranking on the 2018 Corruption Perceptions Index (CPI) by three points and moved to 78th position with a score of 41. India ranked at 81st place on the Corruption Perceptions Index 2017. In the list of 180 countries, China and Pakistan lagged far behind India at 87th and 117th position, respectively.

According to the Index, Denmark is the least corrupt country followed by New Zealand; while Somalia, Syria and South Sudan are the most corrupt countries in the world.

4. UP Cabinet approves construction of Ganga Expressway to connect Prayagraj with Western UP

Uttar Pradesh State Cabinet on January 29, 2019 approved the construction of a four-lane Ganga Expressway connecting Prayagraj to Western Utter Pradesh. Ganga Expressway will provide better connectivity to Prayagraj. Once completed, it would be longest expressway in the world.

The Cabinet also gave its assent for the Bundelkhand Expressway and the development of the Bundelkhand region. The Bundelkhand Expressway will be 296 km long and would cost Rs 8,864 crore. It will pass through 182 villages.

5. India signs agreement with OECD for participation in PISA 2021

The Union Human Resources Development Ministry on January 28, 2019 signed an agreement with Organisation for Economic Co-operation and Development (OECD) for India’s Participation in Programme for International Student Assessment- PISA 2021.

The student assessment by PISA will ensure learning outcome through education. It would lead to an improvement in the learning levels of the children and enhance the quality of education in the country.

It would also indicate the health of the education system of the nation and would motivate other schools and states in the subsequent cycles.

6. SC forms Constitution Bench to hear plea challenging ‘Hindu prayers’ in Kendriya Vidyalayas

The Supreme Court on January 28, 2019 constituted a Constitution Bench for hearing a plea challenging the mandatory requirement to recite Sanskrit and Hindi prayers in morning assembly sessions of 1,125 Kendriya Vidyalayas (KVs) across the country.

The bench of Justices R F Nariman and Vineet Saran observed that the matter of Hindu prayer recitation in Kendriya Vidyalayas required examination by constitution bench and accordingly placed the matter before the Chief Justice of India Ranjan Gogoi to constitute bench.

7. Train 18 named as ‘Vande Bharat Express’; set to run between Delhi and Varanasi at speed of 160 kmph

The Union Minister of Railways and Coal, Piyush Goyal on January 27, 2019 named India's first engineless train, ‘Train 18’ as the 'Vande Bharat Express', acknowledging its made-in-India status. The train was manufactured by the Integral Coach Factory (ICF) in the period of 18 months under the 'Make in India' initiative of PM Narendra Modi.

Vande Bharat Express is the next major leap for Indian Railways in terms of speed and convenience. It is India's first semi-high speed train equipped with world class passenger amenities.

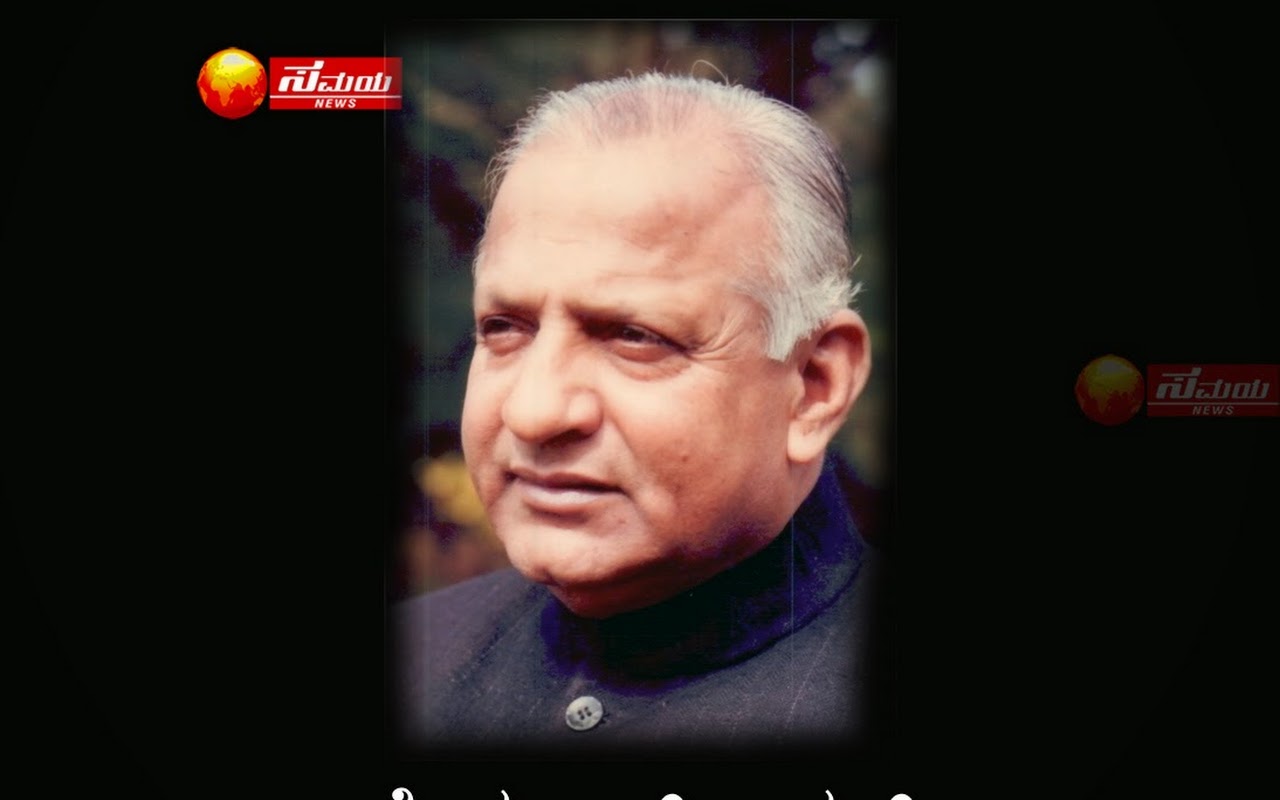

The President, Ram Nath Kovind on January 25, 2019 conferred the 2019 Bharat Ratna Award, country's highest civilian honour, on former president and Congress leader Pranab Mukherjee. The award was also conferred on RSS ideologue Nanaji Deshmukh and singer Bhupen Hazarika, both posthumously.

Congress leader Pranab Mukherjee, who was the 13th President of India and served from 2012 until 2017, had served under Indira Gandhi. He was also the Finance Minister under the premiership of Manmohan Singh.

9. Padma Awards 2019 announced: Gautam Gambhir, Prabhu Deva, Late Kader Khan among awardees

The Padma Awards 2019, one of the highest civilian awards of India, were announced on January 25, 2019 on the occasion of Republic Day eve.

This year, President Ram Nath Kovind approved conferment of 112 Padma Awards including one duo case (in a duo case, the Award is counted as one). The list comprises 4 Padma Vibhushan, 14 Padma Bhushan and 94 Padma Shri Awards, of which, 21 of the awardees are women.

10. CBI Dispute: Alok Verma resigns after PM Modi-led panel removed him as CBI Chief

The sacked CBI Chief, Alok Verma on January 11, 2019 announced his resignation from service, refusing to take charge of the new role as DG, Fire Services. The move comes a day after a high-powered selection committee headed by Prime Minister Narendra Modi removed him from the post of CBI Director in a 2:1 vote, less than 48 hours after he was reinstated to the position by the Supreme Court after he was sent on forced leave by the government.

The selection panel removed Verma from the post over charges of corruption and doubtful integrity as per the findings of the Central Vigilance Commission. There were eight counts of charges against him in the CVC report presented before the Committee. This makes him the first chief in the history of CBI to be ousted from the post.

11. Kumbh Mela 2019: World's largest religious and cultural human congregation begins in UP

The world's largest religious and cultural human congregation, ‘Kumbh 2019’ began at Prayagraj (erstwhile Allahabad), Uttar Pradesh on January 15, 2019 and will go on till March 4, 2019.

This 7-week event began with the holy dip at Sangam, the confluence of three rivers - Ganga, Yamuna and mythical Saraswati. The first bathing was taken by saints and seers of different Akharas. According to the UP Government, over 12 crores devotees and tourists are expected to visit Prayagraj during the Kumbh.

12. 10% reservation for economically weak in general category comes into force

The Constitution (103rd Amendment) Act, 2019, the Act providing 10 percent reservation in government jobs and educational institutions to Economically Weaker Sections (EWS) of General Category, came into effect on January 14, 2019.

The move came after the Union Government exercised its powers conferred by sub-section (2) of section 1 of the Constitution (One Hundred and Third Amendment) Act, 2019 and appointed January 14, 2019 as the date on which the provisions of the said Act shall come into force.

Railways Minister Piyush Goyal on January 23, 2019 announced that the Indian Railways will initiate the fresh recruitment of around 2,30,000 more employees under various cadres over the next two years in two phases.

This will be the first major recruitment in India with the benefit of 10 percent reservations for Economically Weaker Sections (EWS) of General Category after the passage of 103rd Constitutional Amendment in the Parliament.

The Recruitment will be for various cadres and minimum eligibility criteria will vary from certification from Industrial Training Institutes or Diploma or Degree in Engineering or Graduation in any discipline, depending on the post.

The Prime Minister, Narendra Modi inaugurated the 15th Pravasi Bharatiya Diwas on January 22, 2019 in his parliamentary constituency, Varanasi, Uttar Pradesh. In the history of Pravasi Bhartiya Diwas, the event is being held for the first time in Varanasi, the cultural and spiritual capital of India.

Prime Minister Narendra Modi and his Mauritian counterpart Pravind Kumar Jugnauth held talks on January 22, 2019 on the sidelines of the event. They discussed ways to boost bilateral trade and investment, including finalisation of a comprehensive economic partnership agreement.

15. Virat Kohli named ICC Test, ODI Player and Cricketer of the year 2018

Indian skipper Virat Kohli on January 22, 2019 became the first cricketer to win all the top three ICC individual awards including the Sir Garfield Sobers Trophy for ICC Cricketer of the Year, the ICC Men's Test Player of the Year and the ICC ODI Player of the Year for his performances in 2018,

The Indian captain, who recently led India to its historic series win down under, was also named the captain of the ICC Test Team and the ODI Team of the year 2018, the line-ups of which were dominated by Indian players. Besides, Indian wicketkeeper Rishabh Pant claimed the ICC's Emerging Cricketer of the Year award.

16. PM Narendra Modi conferred with first-ever Philip Kotler Presidential Award

The Prime Minister Narendra Modi was on January 14, 2019 conferred with the first-ever Philip Kotler Presidential Award. The Award focuses on the triple bottom-line of ‘People, Profit and Planet’. The award will be offered annually to the leader of a Nation.

As per the award citation, the Prime Minister has been selected for his outstanding leadership for the nation. It is under his leadership that India is now identified as the Centre for Innovation and Value Added Manufacturing (through Make in India initiative).

17. Gujarat becomes first state to implement 10 per cent quota for EWS in general category

Gujarat Chief Minister Vijay Rupani announced on January 13, 2019 that his government will implement the 10 per cent reservation for economically weaker sections of the general category with immediate effect.

The announcement comes less than a week after the Indian Parliament passed a constitutional amendment bill to facilitate 10 per cent reservation for upper castes in higher education and employment.

18. ISRO launches Kalamsat, Microsat-R satellites on PSLV-C44 rocket

The Indian Space Research Organisation (ISRO) launched a students' satellite Kalamsat and an imaging satellite Microsat-R from the Satish Dhawan Space Centre in Sriharikota, Andhra Pradesh on January 24, 2019, marking its first launch of the ISRO in 2019.

The national space agency's rocket, PSLV C44 carried the satellites into the orbit. After about 14 minutes into the flight, the rocket ejected 700-kg Microsat R satellite at an altitude of about 277 km.

The Kalamsat is a 10 cm cube nanosatellite weighing about 1.2 kg and has a life span of about two months.

19. Veteran Bollywood actor-writer Kader Khan passes away

Veteran Bollywood actor-director and scholar, Kader Khan passed away on January 1, 2019 following a prolonged illness in Toronto, Canada. He was 81. He is survived by his wife Hajra, son Sarfaraz, daughter-in-law, and grandchildren.

He was known for his comic roles in films like Dulhe Raja, Aakhein, Coolie No. 1, Haseena Maan Jayegi, and several others. Despite being an actor, he was also a prolific writer. He wrote the story or dialogues for more than 250 films in Hindi and Urdu, beginning with Randhir Kapoor - Jaya Bhaduri starrer ‘Jawani Diwani’ (1972).

20. Justice T B N Radhakrishnan sworn in as first Chief Justice of Telangana HC

Justice Thottathil Bhaskaran Nair Radhakrishnan was on January 1, 2018 sworn in as the first Chief Justice of the Telangana High Court.

The oath to the office was administered to Justice Radhakrishnan by Telangana and Andhra Pradesh Governor ESL Narasimhan at a ceremony held at Raj Bhavan. The ceremony was attended by Telangana Chief Minister K Chandrasekhar Rao and other judges, lawyers and senior government officials. With this, the state of Telangana will have its first independent high court.

The Union Cabinet, chaired by Prime Minister Narendra Modi, on January 2, 2019 approved the ‘Scheme of Amalgamation’ for merger of Bank of Baroda, Vijaya Bank and Dena Bank.

The amalgamation will be the first-ever three-way consolidation of banks in India. The merger of Bank of Baroda, Dena Bank and Vijaya Bank was proposed by the Union Finance Ministry on September 17, 2018.

The amalgamated entity will be India's second largest Public Sector Bank and India’s third largest bank with a total business of more than Rs 14.82 lakh crore.

22. Bill to make marital rape a crime introduced in Lok Sabha

A private bill titled the Women's Sexual, Reproductive and Menstrual Rights Bill 2018 has been introduced in the Lok Sabha by Congress MP Dr Shashi Tharoor. The bill proposes to make marital rape a crime and gives more decisional autonomy to women in termination of pregnancy.

The bill proposes the deletion of exception 2 to Section 375 of Indian Penal Code, which states that sexual intercourse by a man with his own wife is not rape. It also grants women an absolute right to termination of pregnancy where they may terminate pregnancy merely by request until the 12th week of pregnancy.

23. Bangladesh Elections 2018: Sheikh Hasina wins third consecutive term as prime minister

Bangladesh’s Prime Minister Sheikh Hasina secured her third consecutive term and fourth overall with a landslide victory in the nation’s general elections. The results were announced by the Election Commission on December 31, 2018.

Sheikh Hasina’s ruling party Bangladesh Awami League and its allies won 288 of the 299 parliamentary seats contested, surpassing its previous election win when it had won 234 seats. This is an unprecedented feat in the country’s political history as no other leader in Bangladesh has been able to win a third consecutive term.

24. Smriti Mandhana named ICC Women’s Cricketer of the Year

India’s left-handed opener Smriti Mandhana has won the Rachael Heyhoe Flint Award for the ICC Women’s Cricketer of the Year. Mandhana was also adjudged as the ICC Women’s ODI Player of the Year. The announcement was made by the International Cricket Council on December 31, 2018.

The 22-year-old, who has also been named in the ICC Women’s ODI Team of the Year and the ICC Women’s T20I Team of the Year, scored 669 runs at an average of 66.90 in 12 ODIs and 622 runs at a strike-rate of 130.67 in 25 T20Is during the voting period, which ran from January 1 to December 31, 2018.

The cricketer had played a crucial role in India’s semi-final appearance at the ICC Women’s World T20 in the West Indies, scoring 178 runs in five matches at a strike-rate of 125.35.

25. Lok Sabha passes Citizenship Amendment bill

The Lok Sabha on January 8, 2019 passed the Citizenship (Amendment) Bill, which seeks to amend the Citizenship Act, 1955 to make illegal migrants who are Hindus, Sikhs, Buddhists, Jains, Parsis and Christians from Afghanistan, Bangladesh and Pakistan, eligible for citizenship. The bill has now been tabled in the Rajya Sabha.

Under the 1955 Act, one of the requirements for citizenship by naturalisation is that the applicant must have resided in India during the last 12 months and for 11 of the previous 14 years. The bill relaxes this 11-year requirement to six years for persons belonging to the all the six religions from the three countries.

26. RBI forms Nandan Nilekani led Committee to boost digital payments

The Reserve Bank of India (RBI) on January 8, 2018 constituted a High-Level Committee on Deepening of Digital Payments to encourage digitisation of payments and enhance financial inclusion. The five-member committee will be headed by UIDAI’s former Chairman Nandan Nilekani.

The committee will review the existing status of digitisation of payments and suggest ways to bridge any gaps in the ecosystem. The Committee will submit its report within a period of 90 days from the date of its first meeting.

27. Vinesh Phogat becomes first Indian athlete to be nominated in Laureus World Comeback of Year Award

Indian star wrestler Vinesh Phogat on January 17, 2019 became the first Indian athlete to be nominated for the prestigious Laureus World Comeback of the Year Award.

Vinesh has been nominated in “Laureus World Sporting Comeback” category for the year 2019 and will be competing for the award with some of the world’s greatest sportsmen including golfer Tiger Woods, Canadian snowboarder Mark McMorris, American alpine ski racer Lindsey Vonn, Japanese figure skater Yuzuru Manyu and Dutch para-snowboarding star Bibian Mentel-Spee.

The Awards will be presented on February 18, 2019 in Monaco, a tiny independent city-state on France’s Mediterranean coastline.

28. PM Modi inaugurates Vibrant Gujarat Global Summit 2019

Prime Minister Narendra Modi inaugurated the ninth edition of the Vibrant Gujarat Global Summit 2019 on January 18, 2019. The summit is being held at the Mahatma Mandir, Gandhinagar, Gujarat.

The theme of the Vibrant Gujarat Global Summit 2019 was “Youth Connect 2019: Shaping A New India – The Story of Billion Dreams”. The heads of five countries including Uzbekistan President Shavkat Mirziyoyev, Rwanda President Paul Kagame, Prime Minister of Denmark Lars Lokke Rasmussen, Prime Minister of the Czech Republic Andrej Babis and Prime Minister of Malta Joseph Muscat are expected to attend the summit.

29. ISRO launches UNNATI Programme

National space agency, the Indian Space Research Organisation (ISRO) on January 17, 2019 launched the UNNATI (UNispace Nano-satellite Assembly and Training by ISRO) programme at the U R Rao Satellite Centre, Bengaluru.

UNNATI is a capacity building programme on nanosatellite development. The programme was launched following an announcement made by ISRO Chairman K Sivan during a symposium in Vienna on June 18, 2018.

30. Brexit: UK Parliament rejects Brexit Deal, May wins no-confidence vote

British Prime Minister Theresa May suffered a crushing defeat in the Parliament on January 15, 2019 when over 100 lawmakers of May's Conservative party - both Brexiteers and Remainers, voted against the Brexit deal.

The lawmakers overwhelmingly rejected Britain’s withdrawal deal by a vote of 432 to 202, a majority of 230 votes, with just 73 days to go until Britain is scheduled to leave the European Union. The withdrawal agreement had been negotiated between Prime Minister Theresa May and the European Union. Britain is scheduled to leave the EU on March 29, 2019.